First of all, you have a TMS (Trade Management System) or Broker Account. If you are searching about how to buy and sell share online in Nepal. This is the complete guide which explain about all the things to know about buy and sell shares in Nepal.

After reading this article, you can buy and sell any company’s shares without any confusion. We have explained about all the necessary things for trading shares. TMS account helps to buy secondary stocks which are already listed in NEPSE.

You need a Demat Account to apply (Buy) for primary shares(IPOs). But you can sell primary (IPOs) as well as Secondary Stocks through broker account(TMS account).

Nepal Stock Exchange (NEPSE) monitor and controlled the share market of Nepal.

There are 50 broker companies in Nepal. These Broker companies provide Trade Management System (TMS) accounts in Nepal. You can choose any broker as your share(stock)trading partner to buy and sell shares online in Nepal.

After opening a Trade Management Account, broker company provides a username for you. You need ‘phone number or email ID’ to login to Facebook. Like this, you need username to log in to TMS account.

After getting the username and password from your broker, you can change TMS account password by putting the password provided by broker. Now you can buy and sell shares online in Nepal easily with TMS system.

Step 1: Put Sell Order

- Put your broker link (tms41.nepsetms.com.np, tms45.nepsetms.com.np, tms51.nepsetms.com.np, etc.) on any browser like Chrome, UC Browser, Mi Browser etc.

- Login TMS account with your Username and Password. Then TMS Account’s Dashboard will open.

- Now, If you are a mobile phone user then click on the menu bottom (Three lines) and then click on order management. If you are a laptop or pc user then directly click on the ‘Order Management section.

- Now click on ‘Buy and Sell’ bottom.

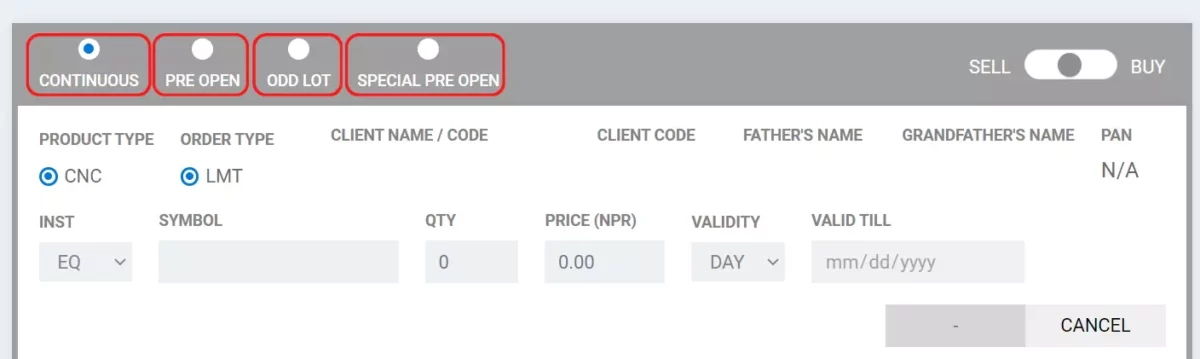

- Now buy and sell interface will display on your screen. Now move the point to the sell-side.

- Then ‘Buy and Sell interface’ color will change to the Red color.

- Now choose session: 1. Continuous(11Am-3PM), 2. Pre-open (10:30AM – 10:45AM) , 3. Special Pre-open(11:30AM-10:45AM First day of transaction), and 4. odd lot( To sell less than 10 units of any shares). We will discuss seasons in detail below. To know about seasons, scroll this post.

- Now type your stock symbol (For example: ADBL for Agricultural Development Bank) on SYMBOL section and put quantity you want to sell on QTY section and Put the price.

- Now click on ‘Sell’. Your stock will be sold when your order matched with buyer.

Step 2: Check Order Status

- You can check your order status by the ‘Daily Order Book’ Section of TMS account. If your stock is sold it will appear in Completed section. If it is not sold then it will appear in the opening section.

After completed your transaction, you should transfer your stock quantity to the broker within next day of transaction day.

If you have not transfer your stock within next day of transaction day, you will pay 20% penalty amount to the broker.

If you have not transfer your stock within next day of transaction day, your stock will not sell. But you must pay 20% penalty.

In this case, you can resell your stock but you should contact to your broker or NEPSE to credit your stock quantity to your TMS account.

After completed your transaction, your sock will be debited from your TMS account but it will not debit from Mero Share account until transfer share.

So, no need to credited to your Mero share account but you must credit your stock on your TMS Account to resell your stock.

To avoid 20% penalty, you should transfer your stock quantity which you sale with next day of your transaction date. But, In case of buying, there is no need to transfer because in this case, broker will transfer stock to your account.

Follow the following steps to transfer:

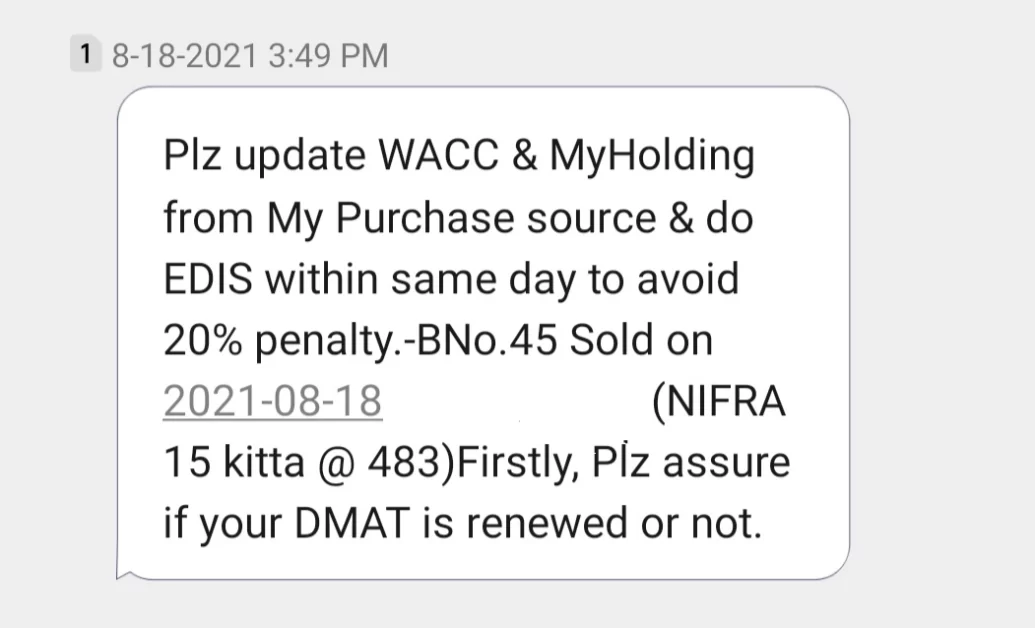

- After closing market, you will get ‘update WACC and Do EDIS’ message from your broker with in 3:00 PM to 8:00PM normally.

- Now, Log in to your Mero share account, then Mero share’s Dashboard will appear.

- Now click on ‘Purchase Source’

- Now, First calculate WACC by clicking on Purchase Source and Select Script which script (Stock) you sale.

- You can calculate your Script (Stock)’s WACC any time but you can calculate holding period, only after the sale of stock.

- Now select script and click on ‘Search’, Now Script detail will show on your screen. Then tick on box and click on proceed.

- After clicking on proceed a confirmation box will appear. Tick on confirmation box and click on ‘Update’. Now your script WACC calculation will completed.

- Now click on ‘MY Holding’ to calculate holding period. We should calculate holding period because of ‘capital gain tax’ difference.

- Now select script and click on search, same as before.

- Now you will see full detail of your stock and holding period. Now tick on box and click on proceed. Again confirmation box will appear, Tick on box and click and update. Now your holding period calculation will be completed.

- If your have not got any EDIS message from your broker, after sale, you should visit broker office to avoid 20% penalty.

- You should pay 7% Capital Gain Tax, if you hold your stock less than one year and you should pay 5% CGT, if you hold your stock more than one year.

- Now, Click on ‘MY EDIS’ and then click on ‘transfer share’ section.

- Now you will see, full detail of your settlement and click on ‘ View Details’

- Now, same as before tick on box and click on proceed. Then confirmation box will appear tick on confirmation box and click on ‘Confirm’.

- Now your script will transfer successfully. After transfer your share, you will get your money in 3-5 days according to your broker service.

Step 1: Load Collateral

To buy shares online we must load collateral on TMS account. There is no need to load Collateral for selling.

Collateral is that amount which broker company collects before buying a stock as a security of transactions. Some broker collects 1/4th of your transaction amount as collateral and some broker collects 1/2nd of the your transaction amount.

For example: If you want to buy 100 units of ADBL shares@Rs.400. Your total transaction amount is Rs. (100*400 = Rs.40,000). In this case, you must load Rs. (40000/4 = Rs. 10,000) as a collateral amount. Some broker collects 50% as collateral, In this case, you must load Rs. (40000/2 = Rs.20000) as collateral.

It means that you should pay 25% or 50% amount before buying a stock. You can easily refund your collateral amount by ‘Refund Collateral Section’ after buying a stock. You can use this collateral amount for future buying. If you refund collateral then you should load again to buy shares in the future.

You can also pay only 75% or 50% amount after buying a stock. If you load collateral 25% then you should pay 75% of your transaction amount because your 25% amount is in collateral. Like this, If you load 50% collateral then you should pay 50% of your transaction amount only.

If you pay 75% or 50% amount after buying a stock, then the broker company use your collateral amount to settle the transaction.

So, there is Three option available for you: (1) Refund, (2) Use for future Buying, (3) Settle the transaction.

Step 2: Put Buy order

- Login to your TMS account and Go to Buy and Sell Section.

- Now, there will appear ‘Buy and Sell interface’ of TMS.

- Now move the point to the Buy-side. Then ‘Buy and Sell interface’ color will change to the Blue color.

- Now choose session: 1. Continuous(11Am-3PM), 2. Pre-open (10:30AM – 10:45AM) , 3. Special Pre-open(10:30 AM-10:45AM )First day of transaction), and 4. odd lot( To sell less than 10 units of any shares). We will discuss seasons in detail below. To know about sessions, scroll this post.

- Now type your stock symbol (For example: ADBL for Agricultural Development Bank) on SYMBOL section and put quantity you want to buy on QTY section and Put the price.

- Now click on ‘Buy’. Your stock will be sold when your order is matched with the seller.

Step 3: Check Order Status

- You can check your order by the ‘Daily Order Book’ Section of TMS account. If your stock is bought, it will appear in the Completed section.

After completing your status. Then nothing need to be done, you will get your sale amount within 3 days. It depends on your broker, some brokers may delay sending money to your account.

What are the trading sessions?

There are 4 trading sessions to buy and sell shares online in Nepal. Above we have discussed about session, lightly. We will discuss this here in detail.

Nepali share market opens 5 days in a week. Sunday to Thursday market will opens for 4 hours(11AM to 3PM).

You can buy and sell shares on these 5days (Sunday to thursday). The market will be closed for Friday and Saturday. If there are any public holidays (Sunday to Thursday) then, market also will close on these days.

1. Special Pre-Open Session

For example: If a new stock listed on NEPSE recently. And today is the first transaction of this stock on the secondary market. On this day, this stock also trading from 10:30AM to 10:45 AM this time called ‘special pre-open’. So, if you are buying this stock at this time(10:30AM -10:45AM) you should tick on special pre-open session of TMS while trading this stock.

2. Pre-Open Session

Pre-open is the same as a special pre-open session time (10:30 AM to 10:45AM). But if you are trading shares (10:30 AM to 10:45AM) that were already trading on the previous days also. Then you should tick on the Pre-open session. For example: If you are trading ADBL Stock at this time (10:30 AM to 10:45 AM) that was already listed on NEPSE and Today is not the first day of this stock on the secondary market. So, in this case, you should tick on the pre-open session.

3. Continuous Session

The market opens for (11:00 AM to 3:00 PM) continuously (Sunday to Thursday) , this time called continuous session. If you are trading at this time, you should tick on the continuous session on Buy and Sell interface.

4.Odd Lot

If you want to Trade (Buy and Sell) less than 10 units of any stock then you should tick on the Odd Lot session of Buy and Sell interface.